Ray Dalio Raises Alarm Over U.S. Credit Rating Downgrade by Moody's

2025-05-19T14:48:35Z

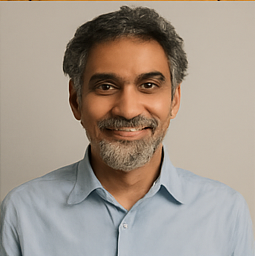

Ray Dalio, the prominent founder of Bridgewater Associates LP and a billionaire investor, spoke out on Monday regarding the recent downgrade of the U.S. sovereign credit rating by Moody's. This warning came on the heels of his appearance at the Greenwich Economic Forum, held in Greenwich, Connecticut, on October 3, 2023, where numerous financial experts gathered to discuss pressing economic issues.

In his statement, Dalio emphasized that the downgrade, which saw Moody's lower the U.S. credit rating from Aaa to Aa1, significantly underplays the potential dangers associated with U.S. Treasurys. He argued that Moody's decision does not fully account for the risk that the federal government may resort to printing more money to meet its debt obligations. Such actions could diminish the value of the currency and, consequently, the money received by bondholders.

Dalio elaborated in a post on X, the social media platform formerly known as Twitter, stating, "You should know that credit ratings understate credit risks because they only rate the risk of the government not paying its debt. They don't include the greater risk that the countries in debt will print money to pay their debts, thus causing holders of the bonds to suffer losses from the decreased value of the money they're getting rather than from the decreased quantity of money they're getting." This perspective highlights a critical flaw in traditional credit rating systems, which could lead investors to underestimate the real vulnerabilities associated with government bonds.

The downgrade by Moody's was attributed to the escalating budget deficit and soaring interest payments associated with the national debt, which have put increasing pressure on the U.S. economy. Notably, this downgrade marks a significant milestone as Moody's is the last of the three major credit agencies to strip the U.S. of its top-tier rating, following similar actions taken by Standard & Poor's and Fitch.

As a direct consequence of this downgrade, U.S. stock markets reacted negatively, with a notable decline observed on Monday. The yield on the 30-year Treasury bond surged to 4.995%, while the yield on the 10-year note rose to 4.521%. These increases in yields reflect investors' rising concerns about the creditworthiness of U.S. government debt and the implications of the downgrade.

In his commentary, Dalio noted, "Said differently, for those who care about the value of their money, the risks for U.S. government debt are greater than the rating agencies are conveying." This statement serves as a stark reminder of the potential pitfalls that investors might face if they rely solely on credit ratings for assessing risk.

Dalio's remarks come at a time when Bridgewater Associates itself has faced challenges, with its assets under management reportedly declining by 18% in 2024, dropping to approximately $92 billion, down from a high of $150 billion in 2021. This downturn illustrates the broader turbulence in the investment landscape, as even seasoned investors like Dalio grapple with changing market dynamics.

Hans Schneider

Hans Schneider

Source of the news: CNBC